Zambia is poised for record copper production this year, bolstering its standing as a key global supplier just as prices surge and demand is set to grow.

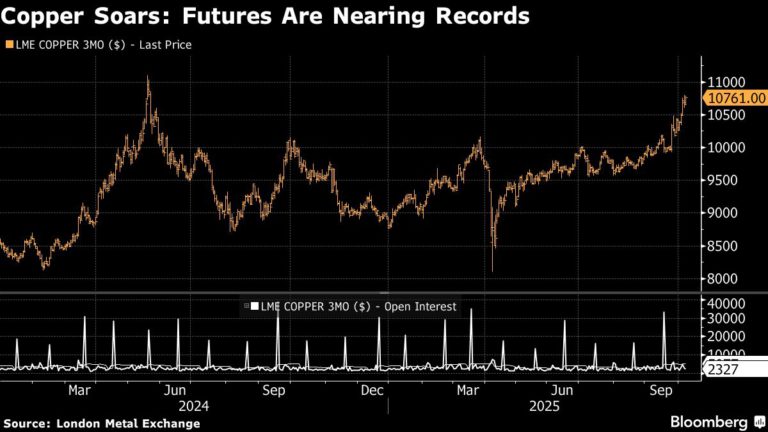

A wave of accidents and disruptions at major mines has squeezed supply and helped drive copper prices up more than 20% this year, and Zambia stands out as one of the few places where output is rising. If it can deliver while rivals stumble, the cash-strapped nation could reap a major windfall.

Zambia plans to seize the moment and expand production. Firms including Barrick Mining Corp., First Quantum Minerals Ltd. and Sinomine Resource Group Co. are investing about $10 billion to boost output. President Hakainde Hichilema, up for re-election in August, has made rapid copper growth central to his pitch, targeting output of 3 million tons annually by early next decade. That would be more than triple current levels.

“We believe in audacious goals,” Jito Kayumba, the president’s special assistant for finance and investment, said in an interview in Zambia’s capital, Lusaka. “We are determined to get to that milestone.”

The global shift to electrify industry, transport and increase renewable power generation is set to underpin rising copper demand. The metal’s use in grids, batteries and construction makes it strategically critical for the energy transition.

Copper is trading near a record high and was up 2.1% at $10,887.50 a ton as of 9:16 a.m. in London. Banks including Goldman Sachs Group Inc. expect further gains as the market moves into a deficit later this decade. The bank raised its 2026 forecast by 5% in an Oct. 6 note. It means producers in Zambia, able to ramp up output, have a rare chance to capitalize on higher prices and lift profits.

The rally stems largely from a string of supply shocks. Earlier this year, a giant copper mine in the Democratic Republic of Congo flooded and Chile suffered its deadliest mining collapse in decades. Last month, a mud flow at the world’s second-biggest copper mine prompted operator Freeport-McMoRan Inc. to slash its production guidance for this year and next. This week, Teck Resources Ltd. cut output guidance for its flagship copper mine in Chile.

Zambia is Africa’s second-biggest copper producer after neighboring Democratic Republic of Congo. Bloomberg calculations show miners have announced more than $10 billion of investments that could add roughly 1.2 million tons of annual output in the 2030s, compared with 821,000 tons last year.

The biggest project now under way is a $2 billion expansion of Barrick’s Lumwana mine near the Congolese border — the centerpiece of the gold producer’s move into copper. Once complete in 2028, Barrick expects to recoup its investment in less than two years if current market levels hold. The work — which management said was progressing slightly ahead of schedule when Bloomberg visited in August — is a mammoth endeavor to double annual production by blasting multiple existing pits into a single vast crater.

Relations between copper producers and Zambia’s government have often been uneasy. Privatization in the 1990s revived the industry after years of state mismanagement, but investment slowed in the 2010s amid frequent tax hikes and disputes over revenue.

Under Hichilema’s pro-business administration, investors are once again racing to tap Zambia’s copper riches — helped by historically high prices.

“The level of investment that’s coming in right now, I don’t think that can be matched in the history of Zambia,” First Quantum chief executive officer Tristan Pascall said in an interview. The company, Zambia’s biggest producer, was among the first to buy assets after privatization, along with Glencore Plc and Anglo American Plc.

Still, the government’s 3 million-ton target won’t be met by the investments pledged so far. Several projects face major hurdles — notably an ambitious underground expansion at a mine controlled by Indian billionaire Anil Agarwal. KoBold Metals Co’s plan to spend more than $2 billion to build the firm’s first mine is also a challenging undertaking.

To get close to the goal, exploration efforts will need to bear fruit too, with global miners including Barrick, Anglo American, Ivanhoe Mines Ltd. and Rio Tinto Group prospecting across the country.

Hichilema hopes Zambia will surpass 1 million tons of production this year for the first time in a century of commercial mining — a boost to government coffers as it emerges from a bruising debt restructuring. The deal with creditors, including bondholders and China, offers larger payouts if the economy outperforms.

Zambia “seems to be on a remarkable turnaround path,” Barclays analysts Michael Kafe and Andreas Kolbe said in an Oct. 7 note to clients after visiting the country. “Major extraction companies have begun to respond to the business-friendly environment that the Hichilema administration has pursued.”