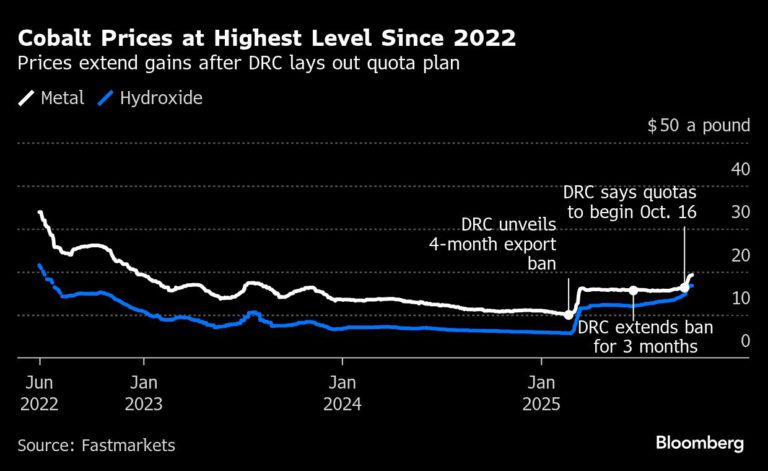

Cobalt prices have extended gains to a three-year high, as export curbs in the world’s top producing country threaten to create a shortage of the battery material and erode confidence in its ability to meet demand.

The ban on shipments by the Democratic Republic of the Congo has roiled supply chains since it was imposed in February, while the quota system that will replace it from Thursday could push the market into deficit as soon as next year. Since the plan was unveiled last month, prices of both the hydroxide and the refined metal have jumped over 20%.

Congo said over the weekend that the quotas are broadly calculated on a pro-rata basis depending on a company’s exports in the three years to end-2024. The country, accounting for about three-quarters of global output, has previously proposed a quota system that could limit yearly exports of the next two years to less than half of 2024 production.

CMOC Group Ltd., which received a little over a third of the quota for the rest of 2025, should be able to export 31,200 tons in 2026 — only 27% of the total output last year from its Congolese mines. The second and third biggest producers, Glencore Plc and Eurasian Resources Group Sarl, were granted 22% and 12% of the allocations through the end of 2025, respectively.

“The quota is lower than expectation for CMOC considering the recent ramp-up in cobalt output since 2022 while CMOC would benefit from hiking cobalt price after the quota policy,” analysts at Citigroup Inc. wrote in a note.

On Monday, the metal is up around 2% on the Wuxi Stainless Steel Exchange. CMOC dropped as much as 7.2% in Shanghai, while other cobalt producers such as Zhejiang Huayou Cobalt Co. rose more than 2%.

Price rally

Cobalt’s applications stretch from heat-resistant components in the aerospace industry to household paints, but batteries are the biggest single source of demand. The world’s top market for electric vehicles is China, and the nation’s refiners dominate processing of the metal.

Congo’s export ban was introduced after output of cobalt, a byproduct of its copper mines, grew more quickly then anticipated and the market plunged. Just before the ban was announced, the metal fell below $10 a pound for the first time since 2015. It’s now nearly double that, while hydroxide has more than tripled in price.

“If this quota is adhered to, there is no question that the market would run out of material before the middle of 2026, suggesting prices could potentially rise higher than in the previous bull market rally in 2022,” Macquarie Group Ltd. said in a note earlier this month, which named cobalt among its three “most preferred” commodities for the next six to nine months.

The restrictions have triggered a number of consequences, in terms of trade flows and refining activity.

Imports collapse

Chinese imports of intermediate cobalt products like hydroxide have collapsed. Inbound shipments in August fell over 90% compared to the same month a year ago, according to customs data. That’s set buyers hunting for alternative sources of feedstock, with No. 2 producer Indonesia likely to pick up more business over the longer term.

“Refined output is already being curtailed to preserve intermediate stocks,” said Thomas Matthews, battery materials analyst at consultancy CRU Group. “Chinese metal production is now at multi-year lows.”

The limited availability of hydroxide from Congo and its outsized gains in price are incentivizing refiners to bypass the material entirely. Instead, some refiners are buying more refined metal to dissolve directly into battery-grade cobalt sulfate, said Roman Aubry, analyst at Benchmark Mineral Intelligence Ltd.

Congo’s rationale for its curbs is to align supply with global demand. Like other developing countries endowed with significant mineral wealth, it’s also keen to build up domestic processing capacity to capture more value from its reserves.

“It remains uncertain whether the country’s punitive and unpredictable regulatory approach will inspire the confidence required for such long-term investments,” wrote trading house Darton Commodities. “The combination of restricted exports and ongoing mine production is likely to result in a growing domestic stockpile of cobalt hydroxide, creating financial strain on producers and raising the risk of informal trade or off-quota leakage.”

The government has a different take, and views the restrictions as “a real lever” for Congo “to influence this strategic market, increase its revenues and improve the living conditions of its population,” President Felix Tshisekedi told his ministers earlier this month.

There will be “exemplary sanctions against any actor involved in fraud or subversive practices, including permanent exclusion from the quota system,” according to minutes of the cabinet meeting on Oct. 3.